I think Junior High School (secondary school) age is where kids really change their perspective on life as they know it–whether from their own hormone changes or society or whatever. In any case, my Dad knew that the same kinds of simple lessons he had been teaching us younger kids were not going to cut it when we hit Junior High.

By this time we knew all the basics–how to save and how to work, how to earn, etc. Now my Dad wanted us to get a taste of…hmmmm, maybe it was financial failure.

No longer were we to receive an “allowance” like we had done in the past, which was discretionary money over an above what our parents spent on us for room, board, clothing, etc. No, Dad had another idea. He had us kids create a BUDGET.

Now, once again Dad made this at least approachable for us kids. All of our food and board was just paid for as part of being in the family. But he knew that CLOTHING was now not just a necessity, it was a WANT. In other words, I wasn’t going to be happy with a pair of sneakers for basketball, I was going to want a specific brand of white leather sneakers that were EXACTLY WHAT EVERYONE ELSE WAS WEARING and probably cost twice as much as what the “just functional” pair of sneakers cost.

He knew that we were going to get into sports or other clubs that cost rather significant amounts of money. We were going to be involved in church and other activities (later dating) that cost money. We were going to want to buy records, stop on the way home for ice cream to socialize with our friends, etc.

He also knew we needed to learn about CASH FLOW.

Therefore, all of a sudden our allowance stopped. Instead, we had to create a YEARLY budget, and get it approved by the Minister of the Department of the Interior (Mom), and then submit it to the head of the Treasury Department (Dad) for dispersal.

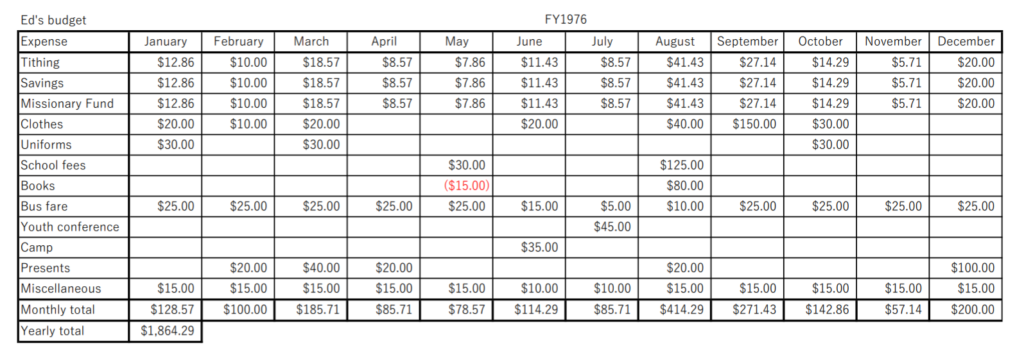

What did this mean? We had to make list of all the expenses we were going to have, and in which month out of the year they were going to occur. Our fiscal year started in January (important because back-to-school was generally the most expensive month, and did not happen till August/September). On this list were things like clothes, haircuts, fees for clubs including gear, fees for events (Youth Conference, camps, etc.), Christmas and birthday present expenses, school supplies and fees, bus fare and later gasoline expenses, that wonderful “miscellaneous expense” and of course, Tithing, Savings, Missionary Fund–which of course had to be back-figured since it would be 10% of what we would be getting. At least, I first assumed that I would be getting the needed amount on a month-to-month bases.

Basically, everything that was an out-of-pocket expense had to be on the list. Mom was no longer doing clothes shopping for me. I wanted to be as independent from her as possible. I wanted to pay all my school and church stuff without her hanging around.

I remember slaving over this list. Trying to guess all the different things I might have to spend money on. Once I got the list done, then I had to realize that this was 70% of the money I was going to ask for, because I also needed to get the 30% for Tithing, Savings, and Missionary Fund. I started to see how math actually helps in “real” life.

Then, I would take the list to Mom. At this point we would discuss discuss both what I had on the list (exactly what was included in “miscellaneous expenses” what usually the hardest part), and whether the amounts were appropriate or not. She was strict, but actually very helpful, and reminded me of things I forgot to include. It usually took a couple of rounds to get it to the point of being ready to submit to the Treasury Department.

When it got to Dad, he would usually whistle and say something like “that’s a lot of money for someone your age”. The effect of this was to scare me to death but at the same time make me feel very responsible.

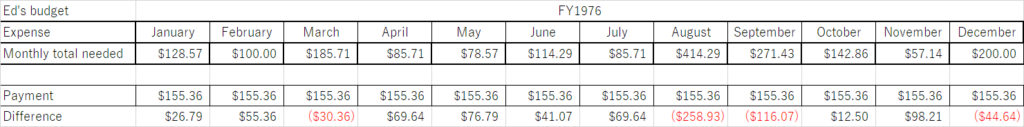

Now, remember that I have made a budget for a year on a MONTHLY basis. August/September always had a huge amount of money because of needing new clothes, having to pay for school expenses and club fees, etc. December was another big one because of Christmas presents. But what did the head of the Department of Treasury do? He said, OK, your total budget for the year is X, and I will pay you in EVEN MONTHLY PAYMENTS of X/12.

He was nice enough to then walk me though my “cash flow” plan. “See how August is going to eat up 3 months worth of your monthly stipend? You better have that much in the bank when you get to that point in the year or you will be wearing last year’s fashion that will also be too small for you!”

That fear kept me saving. But if something came up I might sneak a little beforehand. “I can get by with 3 shirts instead of 5” I would tell myself. Yeah, well it didn’t always work out that way. To be honest, the first year I was on the budget plan we did have to have an emergency meeting of congress (the family) to determine if relief could be provided for “over-budget expenses not previously approved”. The younger kids were amazed but also scared to death at the amount of money in my budget, and knew that their turn was coming, so they dare not say anything to derail approval of additional budget allowance.

Although very painful for the first couple of years, by high school I was pretty proficient at forecasting and calculating, as well as pleading my case for those “miscellaneous expenses”.

But now that I have become an adult and have opportunity to talk with others who never had the chance of experiencing these kinds of things in a safety net environment, but instead entered society without first learning them, I realize that this stuff is not self-evident to people.

I have been approached by people who say “if you can just loan me 50,000 yen (about $450 USD) I will be fine”. Being the stickler that I am I make them do a three-month budget and can usually show them that because of cash flow issues the 50,000 yen would only keep them going for a couple of weeks, and they really need 200,000 yen, and that if they don’t either cut expenses or increase their income, even that won’t work in the long term.

Honestly, I hate all things that have to do with finance. I hate doing budgets. I don’t think I have ever done as detailed a budget since I have been in the workforce as I did each year when I was a student and was still living off my parents. I have been blessed to always have a good-paying job (of course I have taken cuts when the company has done poorly and gotten bonuses when it did well), and a pragmatic wife who has handled our money since we were married. But I think my father’s teaching allowed me to develop an ability to know if I am getting into trouble before it happens, and spurs me to immediately take steps to mitigate the trouble. I know how to do budgets and can immediately teach anyone else how to do one, and how to check their cash flow using a notebook from the 100 yen shop.

Thank you Bro. Ray for sharing this, we learned a lot and looking forward also to share and teach this to our future kiddos. Have a healthy, blessed and happy life ahead!

You are welcome!

We all want our kids to have it easier than we had it when we were kids. But lately as a society we are generally pretty well off, so it is rare that our kids have to “wait” for anything. I seriously think this causes problems for kids long term, so finding ways of helping them learn values is really important.